Corporate Governance

Compensation System

Compensation system for the members of the Management Board of ElringKlinger AG

An independent automotive supplier with global operations, ElringKlinger is currently pursuing the goal of actively shaping the transition toward alternative drive concepts as an innovative development partner to the automotive industry. To achieve this goal, a strong strategic focus on sustainable and profitable growth is considered essential. The present Management Board compensation system is designed to facilitate, through targeted incentives, the process of implementing the corporate strategy defined for the Company and achieving the goals set as part of this strategy.

In conceiving the compensation system, the Supervisory Board was determined to ensure that compensation in respect of Management Board members should take into account their performance and their contribution to the sustainable and long-term development of the Company, thereby embracing the principle of “pay for performance.” To this end, key performance indicators of the ElringKlinger Group have been incorporated within the compensation system as performance criteria relating to variable compensation. Ambitious performance hurdles and targets have been put in place to ensure that the payment of variable compensation is closely linked to the economic accomplishments of the Group. In addition to core financial performance indicators, central non-financial performance criteria are also implemented as an incentive to execute the Company’s strategic initiatives and achieve its sustainability goals, while also taking into account the interests of important stakeholders (particularly customers and employees). Furthermore, the compensation system of the Management Board is directly aligned with the interests of the Company’s shareholders. The largest proportion of variable compensation is linked to the long-term performance of ElringKlinger stock on the capital market. In addition, members of the Management Board are obliged to acquire a significant holding of ElringKlinger shares and to retain them beyond their period of service. Furthermore, the intention for the future is that the compensation systems in respect of the Management Board and senior executives shall set incentives that essentially point in the same direction (consistency).

The compensation system relating to the Management Board, as presented below, complies with the regulatory requirements of the German Stock Corporation Act (Aktiengesetz – AktG) and takes into account the recommendations of the German Corporate Governance Code (GCGC).

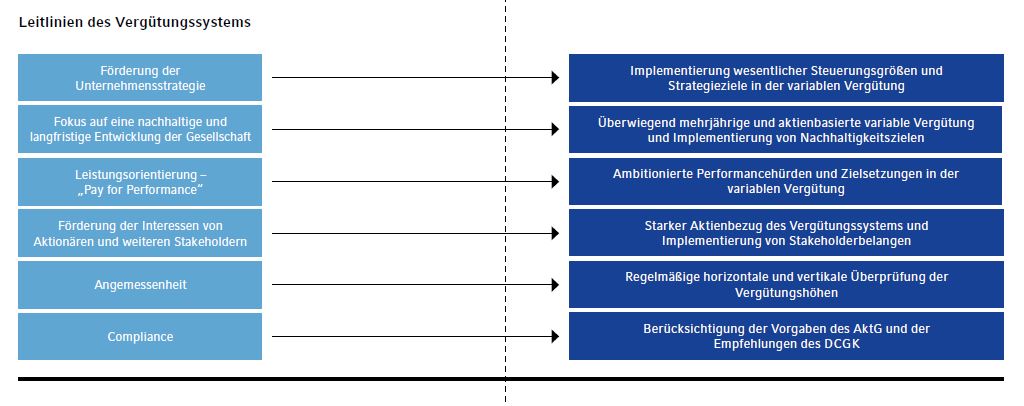

In structuring and defining the compensation system for the Management Board, the Supervisory Board has taken into account the following principles and implemented them as follows:

The present system relating to the compensation of Management Board members shall apply to the remuneration of the members of the Management Board of ElringKlinger effective from January 1, 2021, with the exception of Mr. Theo Becker, who intends to adhere to the previous compensation system for the term of his employment contract until January 31, 2023. Compensation entitlements, including those relating to specific regulations applying to variable remuneration, for periods prior to January 1, 2021, shall continue to be based on the respective underlying contractual provisions.

In accordance with Sections 87a(1), 120a(1) of the German Stock Corporation Act (Aktiengesetz – AktG), the Supervisory Board, aided by preparations made by its Personnel Committee, decides upon a clear and comprehensible compensation system for the Management Board and submits it to the general meeting for approval. This compensation system was adopted by the Supervisory Board on September 30, 2020, and was submitted to the Annual General Meeting on May 18, 2021, for approval.

In the event of significant changes to the compensation system, the Supervisory Board shall resubmit the compensation system to the next Annual General Meeting for approval. Provided that no significant changes are made to the compensation system, a submission in respect of the compensation system will be made at least every four years. If the compensation system adopted by the Supervisory Board is not approved, the Supervisory Board shall submit a revised compensation system at the subsequent Annual General Meeting at the latest, pursuant to Section 120a(3) of the German Stock Corporation Act (Aktiengesetz – AktG).

The Supervisory Board is entitled to seek assistance from an external compensation consultant with regard to the specific structure of the compensation system. In this context, the Supervisory Board shall ensure the consultant’s independence from the Management Board and the Company. The Supervisory Board made use of this option in the course of revising the compensation system.

The general rules set out in the German Stock Corporation Act (Aktiengesetz – AktG) and the German Corporate Governance Code (GCGC) with regard to handling conflicts of interest within the Supervisory Board and the Personnel Committee were observed in respect of procedures for the establishment, implementation, and review of the compensation system and shall also continue to be observed in the future.

The Personnel Committee reviews the level of Management Board compensation at predefined intervals and advises the Supervisory Board on appropriate adjustments where required. These recommendations are decided upon by the plenum. The recommendations take into account the size and international operations of the Company, its economic and financial situation, its prospects for the future, the level and structure of management board compensation offered by similar companies, and the compensation structure in place in other areas of the Company. In addition, the duties and performance of each member of the Management Board and of the Management Board as a whole are taken into consideration. Compensation is set at a level that ensures it is competitive within the market for highly qualified managers and provides an incentive for successful work in a corporate structure with a strong focus on performance and achievement. On this basis, the Supervisory Board determines the amount of target total compensation for each Management Board member.

4.1 Components of compensation

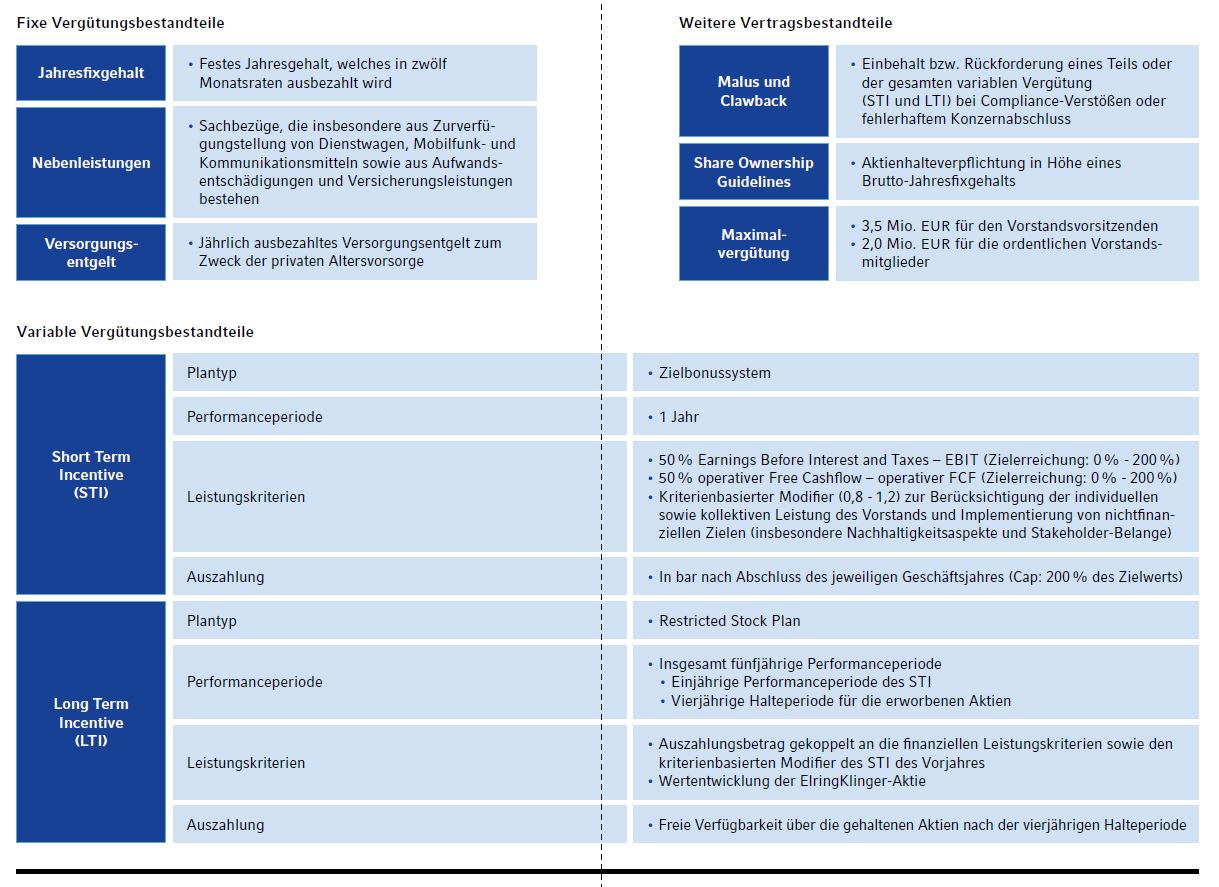

Compensation in respect of the Management Board members consists of fixed and variable components. Fixed compensation comprises a fixed annual salary, fringe benefits, and a pension benefit allowance.

The requirements under stock corporation law for Management Board compensation were extended by the transposition of the Second European Shareholder Rights Directive into German law (ARUG II) as of January 1, 2020. In addition, the new GCGC, as adopted by the Government Commission on December 16, 2019, came into force on March 20, 2020. Against the backdrop of significant changes within the legal and regulatory framework, the Supervisory Board decided, in particular, to revise fundamentally the variable compensation components granted to Management Board members.

The annual bonus (formerly: Long-Term Incentive I – or LTI I) was converted into a one-year target bonus system (in future: Short-Term Incentive – STI), which takes up key performance indicators relating to corporate management and also provides the basis for considering specific strategy and sustainability targets. The former Long-Term Incentive II (LTI II) was revised and converted into a Restricted Stock Plan (Long-Term Incentive – LTI) with a total five-year performance period. The new Long-Term Incentive is closely aligned with the interests of the Company’s shareholders and complies with the recommendations of the GCGC, according to which variable compensation for Management Board members shall be granted predominantly as share-based remuneration and shall be accessible to Management Board members only after a period of four years.

Summary of compensation components under the provisions of the new system:

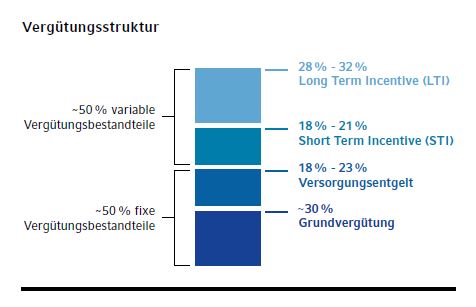

4.2 Compensation structure

The share of the fixed annual salary in target total compensation payable to the Management Board members, i.e., total compensation in the case of 100% target achievement of the variable compensation components, is around 30%. The Short- Term Incentive accounts for approximately 18% to 21% of target total compensation, while the Long-Term Incentive accounts for approximately 28% to 32% of target total compensation. The benefit allowance in respect of private pension provision accounts for roughly 18% to 23% of total target compensation. In addition, fringe benefits are granted at a level that is customary within the market.

Within the context of the compensation structure, the Company thus ensures that variable compensation resulting from the attainment of long-term targets exceeds the percentage share associated with short-term targets. Thus, the focus is directed towards the long-term and sustainable development of ElringKlinger, as required by law, while at the same time an incentive has been established in respect of annual operational targets.

Summary of the compensation structure under the provisions of the new system:

4.3 Maximum compensation

In accordance with Section 87a(1), sentence 2, no. 1 of the German Stock Corporation Act (Aktiengesetz – AktG), the Supervisory Board has set a maximum amount for each member of the Management Board with regard to the sum of annual fixed salary, fringe benefits, and pension benefit allowance as well as Short-Term Incentive and Long-Term Incentive. This amounts to EUR 3.5 million for the Chairperson of the Board (CEO) and EUR 2.0 million for the ordinary members of the Board. The maximum limit refers to the sum of all payments resulting from the compensation arrangements for a financial year.

5.1 Fixed compensation components

5.1.1 Annual fixed salary

The annual fixed salary is a cash payment in respect of the applicable financial year; it takes into account the area of responsibility of the individual Management Board member and is paid in twelve monthly installments.

5.1.2. Fringe benefits

The members of the Management Board receive taxable benefits in kind (fringe benefits) that mainly consist of the provision of a company car, mobile phone, and communication devices as well as insurance benefits.

5.1.3. Benefit allowance

The Supervisory Board has abolished the previous commitment to an annual pension (defined benefit commitment) and will in future instead grant a so-called pension benefit allowance – a lump sum earmarked specifically for private pension provision. Thus, the Company is not exposed to any interest rate or biometric risks generally associated with the financing of a Company pension plan. In addition, the company has eliminated the complexity arising from the actuarial calculation and administration of legacy commitments, thereby increasing the transparency and comprehensibility of the Management Board’s compensation system.

5.2 Variable compensation components

The variable compensation components are geared towards both the short-term and the long-term performance of ElringKlinger. Thus, the variable compensation components are aimed at promoting the implementation of both operational and strategic corporate goals. The variable compensation components provide the appropriate incentives for the Management Board to act in the interests of the Company’s strategy, shareholders, customers, and employees as well as other important stakeholders. A clearly defined “pay for performance” approach has been adopted to ensure that performance above an ambitious target is appropriately rewarded, while the variable compensation components can be reduced to zero if performance falls considerably short of defined targets.

5.2.1 Short Term Incentive

a. Summary of Short-Term Incentive

The members of the Management Board receive a short-term incentive directed at their performance during the respective financial year, the aim being to promote the operational execution of ElringKlinger’s corporate strategy.

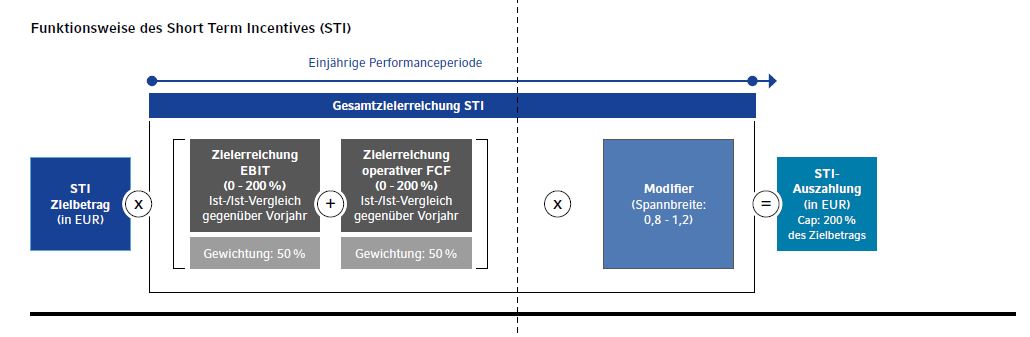

Alongside financial performance criteria, non-financial performance criteria have also been included in the Short-Term Incentive; they are taken into account via a so-called modifier when determining payments relating to the Short-Term Incentive. The two financial performance criteria each have a weighting of 50% and are interconnected on an additive basis. The modifier can be set by the Supervisory Board within a range of 0.8 to 1.2; it can thus influence payouts from the Short-Term Incentive both downwards and upwards by a maximum of 20% in each case.

A target amount set by the Supervisory Board prior to the beginning of a financial year, to be paid out if 100% of the target is achieved, forms the basis for possible payments from the Short-Term Incentive. The amount paid in respect of the Short-Term Incentive is calculated by multiplying the target amount by the level of target attainment of the financial performance criteria, which can be between 0% and 200%, and the individually defined modifier. The total amount paid out under the Short-Term Incentive is limited to 200% of the target amount.

b. Financial performance criteria of the Short-Term Incentive

The key financial performance criteria for the Short-Term Incentive are EBIT generated by the ElringKlinger Group (earnings before interest and taxes; EBIT) and operating free cash flow (operating FCF). The two financial performance criteria EBIT and operating FCF each have a weighting of 50% in respect of the Short-Term Incentive and are among the most important financial performance indicators used by the Company.

EBIT refers to earnings before interest and taxes and corresponds to the operating profit/loss before taking net finance costs into account. EBIT is a key indicator of the ElringKlinger Group’s operating profitability and, as such, is also reflected in the Short-Term Incentive. Operating free cash flow encompasses cash flow from operating activities less cash flow from investing activities, adjusted for payments in respect of acquisitions and investments in financial assets as well as proceeds from divestments. Operating FCF is a central control parameter used for the purpose of mapping the Company’s internal financing potential and the liquidity inflow from its operating business.

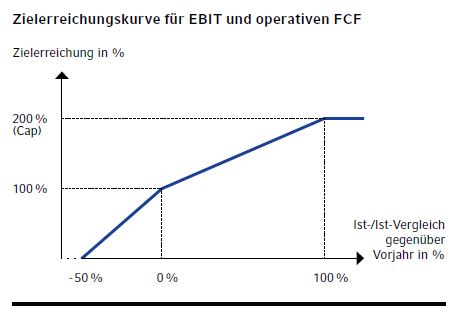

As regards both EBIT and operating FCF, target attainment is determined on the basis of a comparison of actual figures with the previous year. Specifically, the actual value achieved for EBIT or operating FCF is compared with the respective actual values achieved in the previous year. If EBIT or operating FCF remains the same as in the previous year, target attainment equals 100%. If EBIT or operating FCF is up by +100 % (maximum value), the target attainment level corresponds to 200% (cap). EBIT or operating FCF of -50% compared to the previous year (minimum value) translates into target attainment is 0%. Any target attainment between the defined target points (0%; 100%; 200%) is interpolated on a linear basis. As soon as the maximum level has been reached, any further increases in EBIT or operating FCF will not result in a higher target attainment level. If the value falls below the minimum value, target attainment corresponds to 0%. If EBIT or operating FCF are negative in both the previous year and the respective financial year or negative in the previous year and positive in the respective financial year under review, the Supervisory Board is entitled to set the target attainment level at its reasonable discretion. If positive EBIT or positive operating FCF is achieved in the previous year and negative EBIT or negative operating FCF is achieved in the respective financial year under review, the target attainment level corresponds to 0%.

c. Non-financial performance criteria and modifiers

The modifier, with a possible range of 0.8 to 1.2, enables the Supervisory Board to assess not only the level of financial target attainment but also the individual and collective performance of the Management Board and, in particular, the achievement of stakeholder objectives on the basis of specific criteria. The criteria for assessment shall be determined by the Supervisory Board at the beginning of each financial year, at the latest within the first three months, and may include, for example, the following aspects:

- individual performance of the Board member (e.g., important strategic achievements in the area of responsibility, individual contributions to significant cross-departmental projects, relevant financial accomplishments in the area ofresponsibility, realization of key projects),

- collective performance of the Management Board (e.g., achievement of important strategic corporate goals including mergers and acquisitions, cooperation with the Supervisory Board, sustainable business development in strategic, technical, or structural terms), and

- matters relating to stakeholders and aspects in respect of sustainability/ESG (e.g., within the areas of occupational health and safety, compliance, production conditions, energy and environment, customer satisfaction, employee matters, corporate culture).

The targets or criteria of the modifier set for the applicable financial year in respect of each member of the Management Board as well as the level of the modifier set for the applicable financial year in respect of each member of the Management Board are published in the compensation report of the subsequent year.

5.2.2. Long-Term Incentive

With a view to promoting the implementation of corporate strategy and the sustainable and long-term performance of ElringKlinger, the members of the Management Board are granted a Long-Term Incentive – in addition to the Short-Term Incentive – in the form of a performance-based restricted stock plan with a total performance period of five years.

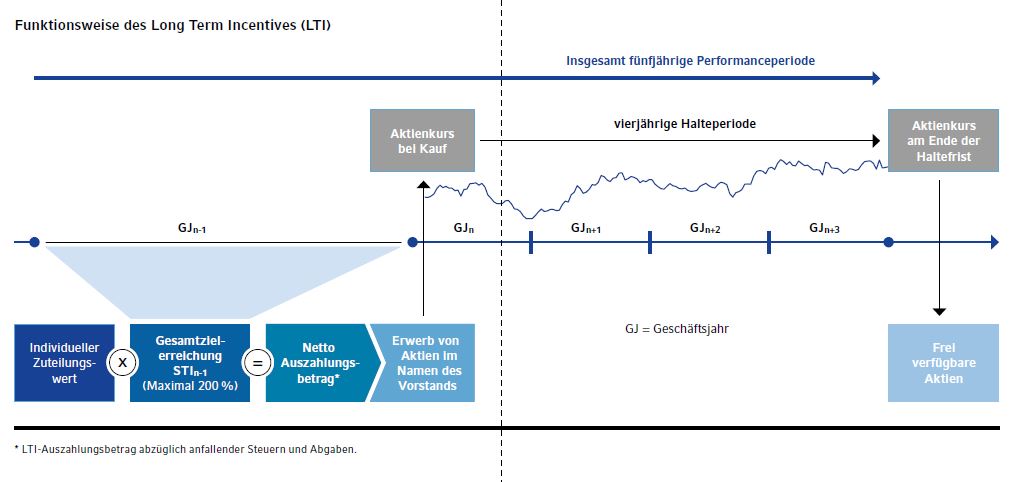

As part of the Long-Term Incentive, the members of the Management Board are entitled to the annual granting of an individual allocation value in euros. The individual allocation value is multiplied by the figure calculated for total target attainment with regard to the Short-Term Incentive of the financial year preceding the grant year. The amount paid out for the respective financial year under review is determined on the basis of this calculation. The amount payable must be fully invested in Company shares after deduction of applicable taxes and duties. These shares must be held for a period of at least four years. The shares shall be acquired by a financial services provider appointed by the Company in the name and for the account of the Management Board member. After the end of the four-year holding period, the Management Board member may freely dispose of the shares acquired under the respective tranche of the Long-Term Incentive. In those cases in which shares are sold subsequent to the end of the holding period, the statutory provisions on insider securities, insider information, and the prohibition of insider trading, in the amended versions, must be observed accordingly.

The system established in respect of the Long-Term Incentive provides an additional incentive for the implementation of important operational objectives by using them as a basis for the allocation of shares. In addition, the majority of the performance-related variable compensation components are linked to the sustainable and long-term development of the ElringKlinger Group; in this context, the direction taken by the share price over the four-year holding period is the key determinant. In this case, the compensation system for the Management Board is aligned directly with the interests of shareholders by providing incentives to achieve a strong performance of ElringKlinger shares on the capital market.

5.2.3. Share ownership guideline

To further align the interests of the Management Board and shareholders and to underpin the sustainable, long-term performance of the Company, additional shareholding obligations, so-called share ownership guidelines, have been incorporated into the compensation system. Under the terms of the agreement, each member of the Management Board is obliged to acquire a fixed number of shares in ElringKlinger equivalent to 100% of the gross annual fixed salary within a period of four years and to hold these shares for at least two years subsequent to the end of the Management Board member’s term of office. ElringKlinger shares already held by the Management Board member or acquired as part of the share purchase obligation under the Long-Term Incentive provisions are counted towards fulfilling the share retention obligation.

5.2.4. Malus and clawback

The employment contracts of the Management Board members include malus and clawback provisions, which apply to their entire variable compensation, i.e., the Short-Term Incentive and the Long-Term Incentive.

If the Management Board member intentionally violates a material duty of care within the meaning of Section 93 of the German Stock Corporation Act (Aktiengesetz – AktG), a material contractual duty, or other material principles of action of the Company, e.g., in respect of the Code of Conduct or the Compliance Guidelines, the Supervisory Board may partially or completely reduce to zero the variable compensation components not yet paid out that were granted for the financial year in which the violation occurred (“compliance malus”).

In addition, the Supervisory Board may, under the aforementioned conditions, also demand partial or full repayment of the gross amount of the variable compensation components that have already been paid out for the financial year in which the violation occurred (“compliance clawback”).

Furthermore, a member of the Management Board shall be obliged to repay a variable compensation component that has already been paid out if and to the extent that it becomes apparent subsequent to the payment that the audited and approved consolidated financial statements on which the calculation of the payment amount was based were incorrect and that a lower payment amount or no payment amount would have been owed in respect of variable compensation on the basis of the revised audited consolidated financial statements (“performance clawback”).

6.1 Appointment and dismissal

The appointment and removal of Management Board members is performed in accordance with Sections 84 and 85 of the German Stock Corporation Act (Aktiengesetz – AktG). The Articles of Association contain no regulations that could be considered non-compliant with the provisions set out by law as regards the conditions applicable to the appointment or removal of Management Board members. The Management Board contracts of service are concluded for the duration of the appointment. This period is usually three years in the case of an initial appointment and five years in the case of a reappointment.

6.2. Entry or exit during the year

In the event of entry or exit during a current financial year, the total compensation, including the target amount of the Short-Term Incentive and the allocation value of the Long-Term Incentive, is reduced pro rata temporis according to the length of service during the financial year in question. In addition, in the event that the employment relationship commences within a current financial year, the overall degree of target attainment of the Short-Term Incentive of the financial year preceding the year of granting, which is used to determine the gross payment amount of the Long-Term Incentive, is set at 100% for the first tranche after commencement of the employment relationship.

In certain cases of termination of employment described below, claims from current tranches of the Short-Term Incentive and the Long-Term Incentive shall lapse without replacement or compensation:

a. Short-Term Incentive

If the contract of service ends due to extraordinary termination by the Company for a compelling reason pursuant to Section 626(1) of the German Civil Code (Bürgerliches Gesetzbuch – BGB) or due to the resignation of the member of the Management Board without a compelling reason and without mutual agreement during the financial year, or if the appointment is revoked by the Supervisory Board for a compelling reason pursuant to Section 84(3) of the German Stock Corporation Act (Aktiengesetz – AktG) during the financial year (except due to a vote of no confidence by the Annual General Meeting), the entitlement to the Short-Term Incentive shall lapse without replacement or compensation.

If the contract of service of the beneficiary ends in the course of a financial year in cases other than those listed above, the member of the Management Board shall be entitled to a pro rata Short-Term Incentive for said financial year determined up to the end of the contract of service.

b. Long-Term Incentive

If the contract of service ends due to extraordinary termination by the Company for a compelling reason pursuant to Section 626(1) of the German Civil Code (Bürgerliches Gesetzbuch – BGB) or due to resignation of the member of the Management Board without a compelling reason and without mutual agreement prior to the end of the grant year of the respective tranche of the Long-Term Incentive, or if the appointment is revoked by the Supervisory Board for a compelling reason pursuant to Section 84(3) of the German Stock Corporation Act (Aktiengesetz – AktG) prior to the end of the grant year of the respective tranche of the Long-Term Incentive (except for a vote of no confidence by the Annual General Meeting), the Management Board member shall be obliged to reimburse the gross payment amount of the tranche of the Long-Term Incentive for the grant year in which the contract of service ends.

If the contract of service of the beneficiary ends in the course of a financial year in cases other than those listed above, the Management Board member shall hold the shares allocated under the Long-Term Incentive in the regular manner until the end of the four-year holding period. When selling the shares subsequent to the end of the holding period, the statutory provisions on insider securities, insider information, and the prohibition of insider trading, in the amended versions, must be observed accordingly.

6.3. Severance pay and severance cap

In the event of premature termination of the contract of service without a compelling reason any payments potentially to be agreed with the Management Board member, including fringe benefits, shall be limited to the amount equivalent to two years’ annual compensation (severance pay cap), but no more than the amount of compensation in respect of the remaining term of this contract of service. The severance pay cap shall be calculated on the basis of the total compensation for the past full financial year and if appropriate also the expected total compensation for the current financial year.

6.4. Continuation of compensation in the event of illness and death

In the event of illness, Management Board members are entitled to continued payment of their monthly fixed annual salary for a period of up to nine months. If the Management Board member dies, his or her surviving dependants shall receive the full compensation, including entitlements in respect of the Short-Term Incentive and Long-Term Incentive, pro rata temporis for six months.

6.5. Secondary employment/activities

The members of the Management Board are obliged to devote their full working capacity exclusively to the Company. They shall not engage in any secondary employment/activities, whether gainful or not, without the prior written consent of the Personnel Committee of the Supervisory Board of the Company. This also includes the assumption of supervisory board mandates. The same also applies to the assumption of honorary offices within the context of what is legally permissible. If requested by the Company, the Management Board members shall also take on responsibilities in affiliated entities. The Management Board members receive no additional compensation for such activities.

Under special and exceptional circumstances, the Supervisory Board may temporarily deviate from the compensation system in accordance with Section 87a(2) sentence 2 of the German Stock Corporation Act (Aktiengesetz – AktG) if this is necessary in the interest of the Company’s long-term well-being. Such departures may be necessary, for example, to ensure adequate incentivization in the event of a severe corporate or economic crisis. Unfavorable market developments, on the other hand, are not considered special and exceptional circumstances justifying any form of departure from the compensation system. The exceptional circumstances underlying and necessitating a deviation shall be determined by a resolution of the Supervisory Board. The components of the compensation system that may be deviated from are the procedure, the regulations on the compensation structure and amount, the provisions governing financial and non-financial performance criteria, in particular with regard to the configuration of the target attainment curves while ensuring that the targets remain appropriately ambitious, and the regulations on the individual compensation components. Even in the event of a departure from the compensation system, compensation and its structure shall continue to be geared towards the long-term and sustainable development of the Company and shall be commensurate with the success of the Company and the performance of the Management Board. In addition, the Supervisory Board has the right to grant special payments to newly appointed members of the Management Board to compensate for salary losses from a previous employment relationship or to cover costs arising from a change of location.

Compensation system for the members of the Supervisory Board of ElringKlinger AG

The key tasks of the Supervisory Board include appointing and dismissing members of the Management Board, supervising and advising the Management Board, adopting the annual financial statements, and approving important corporate plans and decisions. Compensation granted to the members of the Supervisory Board of ElringKlinger shall be commensurate with their responsibilities and the situation of the Company. At the same time, it is in the Company’s interest to be attractive to suitable candidates for the ElringKlinger Supervisory Board. Therefore, compensation payable to the Supervisory Board members must also correspond to that applicable within the market in comparison with other companies. In this context, appropriate and market-driven compensation of the Supervisory Board members is conducive to a favorable long-term performance of the Company.

Pursuant to Section 113(3) of the German Stock Corporation Act (Aktiengesetz – AktG), a resolution on compensation granted to the members of the Supervisory Board shall be passed by the Annual General Meeting at least every four years. The general meeting can confirm the compensation system or decide on amendments. As a rule, amendments are made on the basis of a proposal by the Supervisory Board and the Management Board.

In accordance with Suggestion G.18 of the GCGC, the Annual General Meeting decided in the 2020 financial year not to grant a variable compensation component in respect of Supervisory Board members. The rationale behind this decision is to also emphasize the independence of the Supervisory Board with regard to its control and advisory function within the framework of the design of the compensation system. The revised compensation system of the Supervisory Board came into effect as of the 2020 financial year.

The Supervisory Board and the Management Board are confident that no further adjustments will be necessary beyond those made to the compensation system of the Supervisory Board last year. Therefore, the compensation system for Supervisory Board members resolved at the 2020 Annual General Meeting will be submitted unchanged to the Annual General Meeting for the purpose of passing a resolution.

The compensation components consist of basic compensation and, in accordance with Recommendation G.17 of the GCGC, of function-based supplements in respect of the chairmanship and deputy chairmanship of the Supervisory Board as well as membership or chairmanship of individual committees of the Supervisory Board. This takes into account the additional workload and scope of responsibility associated with the respective function.

Compensation payable to the members of the Supervisory Board is set out in Article 13 of the Articles of Association and is as follows:

2.1 Basic compensation

Each member of the Supervisory Board receives fixed compensation of EUR 50,000 per annum.

2.2 Function-based supplements

a. Chair and Deputy Chair of the Supervisory Board

The Chairperson of the Supervisory Board shall receive an annual supplement on basic compensation in the amount of twice the basic level of compensation and the Deputy Chairperson of the Supervisory Board shall receive a supplement in the amount of one times the basic compensation.

The supplements reflect the fact that the Chairperson of the Supervisory Board holds a special position within the Supervisory Board. He coordinates and organizes the Supervisory Board’s activities and is the primary point of contact for the Management Board. The Deputy Chairperson of the Supervisory Board shall assist the Chairperson in these tasks.

b. Committee members

Membership in a committee of the Supervisory Board is remunerated with an annual supplement of EUR 6,000. As regards membership relating to the Audit Committee the supplement is EUR 10,000. Membership in the Mediation Committee shall only be remunerated with the annual supplement if this committee is required to act in the course of the calendar year. No supplement shall be made for membership in the Nomination Committee.

Committee work demands an additional time commitment from committee members. With the exception of the Mediation and Nomination Committees, the committees meet several times during the calendar year. This applies in particular to activities as a member of the Audit Committee.

c. Committee Chair

Committee chairpersons shall receive double the supplement for committee membership. This does not apply to the Chair of the Mediation and Nomination Committee, which is held by the Chairperson of the Supervisory Board by virtue of his office. The additional time commitment is covered by the supplement granted in respect of the chairmanship of the Supervisory Board. This does not apply to the Chairpersons of the other committees. Therefore, the additional commitment of time is remunerated accordingly.

2.3 Attendance allowances

Members of the Supervisory Board shall receive an allowance of EUR 1,000 for each attendance at an ordinary meeting of the Supervisory Board.

2.4 Date of payment, pro rata payment

Compensation for each member of the Supervisory Board is paid at the end of each year. The attendance allowance is due after each meeting. If members of the Supervisory Board leave the Supervisory Board or a specific function or membership in a committee during the year, compensation shall only be granted on a pro rata basis. The same shall apply in the event of joining the Supervisory Board, membership of a committee, or assumption of a function during the year.

2.5 Reimbursement of out-of-pocket expenses

Expenses, in particular travel expenses, relating to Supervisory Board activities shall be reimbursed by the Company to a reasonable extent upon presentation of proof.

2.6 D&O insurance

The members of the Supervisory Board are covered as insured members of governing bodies by a financial loss insurance policy for governing bodies and specified executives (directors’ and officers’ liability insurance – D&O insurance) taken out by the Company at its discretion.

No compensation-related legal transactions within the meaning of Section 87a(1), sentence 2, no. 8 AktG have been concluded with members of the Supervisory Board.

Declaration of Conformity

Declaration of Conformity with the German Corporate Governance Code by the Supervisory Board and the Board of Management pursuant to Section 161 of the German Stock Corporation Act.

Corporate Governance Statement

The corporate governance declaration pursuant to § 289f and §315d of the German Commercial Code (HGB) includes in particular the declaration of conformity with the German Corporate Governance Code.

Declaration of Conformity

Declaration of Conformity with the German Corporate Governance Code by the Supervisory Board and the Board of Management pursuant to Section 161 of the German Stock Corporation Act.

Corporate Governance Statement

The corporate governance declaration pursuant to § 289f and §315d of the German Commercial Code (HGB) includes in particular the declaration of conformity with the German Corporate Governance Code.