Dettingen/Erms, Ulm, August 27, 2021 +++ Science and industry are currently driving forward the industrial production of fuel cells for vehicles. To this end, the Research Factory for Hydrogen and Fuel Cells (HyFaB) is being established at the Center for Solar Energy and Hydrogen Research Baden-Württemberg (ZSW) in Ulm. Here, experts are developing the necessary prerequisites and processes for large-scale production. In cooperation with EKPO Fuel Cell Technologies (EKPO), the ZSW is currently realizing a generic fuel cell stack as a pre-competitive and manufacturer-independent development platform. Its size, design and power density will correspond to the fuel cell systems currently used in the automotive sector. Its components should be available for research projects and for companies from mid-2022.

"Fuel cells were already on the verge of market launch twenty years ago. However, at that time they failed primarily due to the availability of hydrogen. This is now changing fundamentally with the European Green Deal and the German Hydrogen Strategy," says Prof. Dr. Markus Hölzle, ZSW board member and head of the Electrochemical Energy Technologies business unit in Ulm. Now the fuel cell must also be industrialized quickly so that it becomes available on the market in large quantities at low cost. That is the goal of the new ZSW project within HyFaB.

"The 'generic fuel cell stack' will create a kind of universal tool for the further technological development of the fuel cell. In addition, we can then provide medium-sized companies with components or entire fuel cells for their own product development," says Hölzle.

Pre-competitive offer to industry

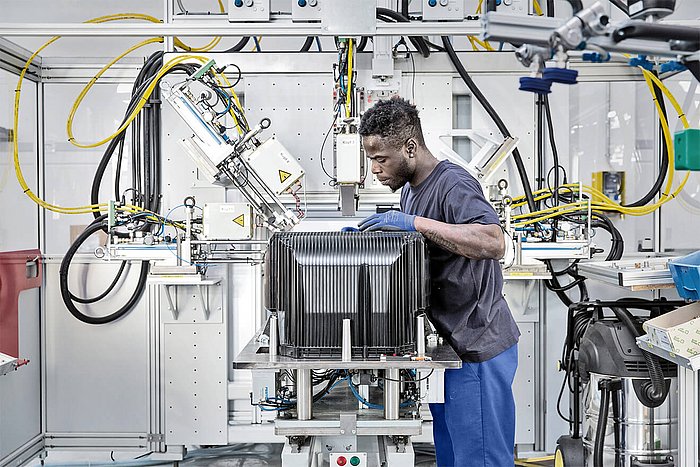

The stack concept is designed for a maximum output of 150 kilowatts. This requires 500 individual cells, each with two metal bipolar plates, to build this generic fuel cell stack. The advantage of metal bipolar plates is that they can be manufactured using forming production processes and thus enable high volumes with short cycle times. However, the thin wall thicknesses of only a tenth of a millimeter at a length of over 40 centimeters per plate are challenging in terms of production technology.

The bipolar plates are crucial components of a fuel cell: On the two outer sides, the so-called cathode and anode, they ensure the even distribution of hydrogen and atmospheric oxygen. At the same time, the cooling water is conducted through the inside of the plates. This is achieved by means of extremely filigree channel and web geometries as well as a distribution and sealing concept. These structures are simulated and optimized using computational fluid dynamics (CFD).

"Participation in this lighthouse project, the close contact with institutional research with the ZSW and the knowledge gained about series production processes as a result offers real added value for us. Above all, HyFaB's highly interesting network for fuel cell stack production, for example with the ZSW or even with the Fraunhofer Institute ISE in Freiburg with their decades of experience in fuel cell research, is enormously important for the automotive and industrial locations of Baden-Württemberg, Germany and Europe. The close cooperation with the plant manufacturers involved in HyFaB opens up exciting new opportunities for us," says EKPO CCO Julien Etienne.

The project is being funded by the Baden-Württemberg Automotive Industry Strategy Dialogue through the Baden-Württemberg Ministry for the Environment, Climate and Energy Management.

The HyFaB

In order to rapidly advance the mass production of fuel cells, the ZSW is establishing HyFaB at the Ulm site as an open industry platform to develop automated manufacturing and quality assurance processes, factory acceptance tests and commissioning of fuel cell stacks. HyFaB is open to partners from the automotive and fuel cell supplier industry as well as mechanical and plant engineering, especially small and medium-sized enterprises (SMEs).

HyFaB is a publicly funded project: the Baden-Württemberg Ministry of Economics is supporting a new building with 3,300 square meters at the ZSW site in Ulm on Lise-Meitner-Strasse with 10.4 million euros. Construction work officially began on February 9, 2021. The German Federal Ministry of Transport has announced a further 30 million euros for industrial projects for production and process research. In addition to the ZSW, Fraunhofer ISE from Freiburg and the VDMA (German Engineering Federation) are also involved in the HyFaB project.

![[Translate to English:] ElringKlinger auf Instagram [Translate to English:] ElringKlinger auf Instagram](/fileadmin/data/images/06-newsroom/01-content/social-media/elringklinger-social-media-instagram-1320x743.jpg)

![[Translate to English:] ElringKlinger auf Facebook [Translate to English:] ElringKlinger auf Facebook](/fileadmin/data/images/06-newsroom/01-content/social-media/elringklinger-social-media-facebook-1320x743.jpg)

![[Translate to English:] ElringKlinger auf LinkedIn [Translate to English:] ElringKlinger auf LinkedIn](/fileadmin/data/images/06-newsroom/01-content/social-media/elringklinger-social-media-linkedin-1320x743.jpg)

![[Translate to English:] ElringKlinger auf Xing [Translate to English:] ElringKlinger auf Xing](/fileadmin/data/images/06-newsroom/01-content/social-media/elringklinger-social-media-xing-1320x743.jpg)