Shanghai, China, Dettingen/Erms, Germany, April 18, 2023 +++ At this year's AUTO SHANGHAI, ElringKlinger is celebrating its 30th anniversary in China and will be showcasing various innovations from the fields of battery and fuel cell technology, lightweight construction as well as from its classic business areas relating to gasket technology at its exhibition booth (Hall 1.2, Booth 1BH008).

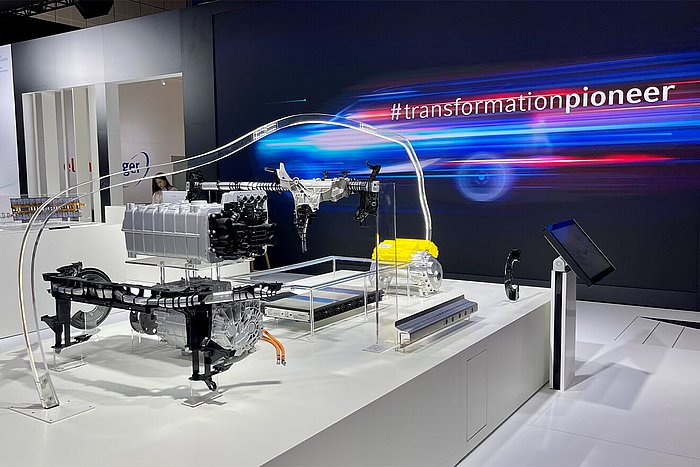

With its motto "#transformationpioneer", ElringKlinger underscores its early focus on alternative drive technologies as well as its good starting position for the ongoing transformation of the automotive and supplier industry. The company has built an intelligent product portfolio that is based on several pillars. "ElringKlinger is in an excellent position with regard to the megatrend of electromobility. We will be using one of the world's largest mobility platform to present our comprehensive portfolio," says Humphrey Chen, General Manager of ElringKlinger China Ltd.

A range of zero-emission mobility products will be installed in a demonstrator vehicle, demonstrating the Group's leading position in providing solutions for current and future generations of vehicles.

ElringKlinger has made a name for itself in the field of battery technology in recent years. For example, the company supplied cell contact systems for the purely battery-electric BMW i3 vehicle. This key component takes over the current conduction as well as voltage and temperature monitoring. ElringKlinger has extensive knowledge in designing and manufacturing large plastic parts, so that we can offer cell contact systems also for cell-to-pack applications. At AUTO SHANGHAI the company will present a cell contact system for prismatic cells using a flexible printed circuit-based signal carrier.

ElringKlinger will also be presenting the ElroSafeTM underbody shield for protecting the battery system, which is made of a thermoplastic sandwich material with glass fiber reinforcement.

The shielding system offers excellent impact behavior as well as thermal and acoustic insulation for battery systems of electric vehicles and ensures a high degree of strength and stiffness combined with low density.

In addition, components for electric drive units (EDU) are showcasted. In an EDU, seals and other components are used in various areas: Electric motor, gearbox and inverter. Different requirements necessiate different, high-end solutions. ElringKlinger offers an extensive portfolio in this segment that will be presented at AUTO SHANGHAI.

Innovative fuel cell technology from EKPO

In 2021 EKPO Fuel Cell Technologies (EKPO), the joint venture between ElringKlinger (60%) and Plastic Omnium (40%), was founded. The company now strengthens its hydrogen business in China more and more. EKPO installed a fuel cell test bench in its Suzhou test lab. A semi-automated fuel cell stack assembly line followed by the end of 2022. The first locally produced stack has already left the factory premises.

“We thus underline our ambitions on the Chinese market with product solutions for various applications. Both the test lab and the assembly line represent milestones in EKPO’s localization strategy in the Asian region, especially in China.” says Humphrey Chen, also General Manager of EKPO Fuel Cell (Suzhou) Co.,Ltd.

EKPO has further strengthened its commitment in China with the establishment of a Chinese subsidiary. Furthermore a joint investment and funding agreement was signed between EKPO and the local government.

At AUTO SHANGHAI EKPO showcases three differenct low temperature fuel cell stack modules (PEMFC) with integrated system functionalities.

The NM5-EVO fuel cell stack module consists of 335 cells and is based on metallic bipolar plates with an electric output of up to 76 kWel. This stack module ist designed for high volume automotive applications.

The NM12 Single fuel cell stack module consists of 359 cells and is based on metallic bipolar plates with an electric output of up to 123 kWel. This stack module ist designed for applications with high power requirements (>100 kW) in the automotive sector (passenger cars and light commercial vehicles).

The NM12 Twin fuel cell stack module consists of 598 cells (2 x 299 cells) and is based on metallic bipolar plates with an electric output of up to 205 kWel. This stack module is designed for applications with high power requirements (>150 kW) in the heavy duty sector.

China is a key market for ElringKlinger

This year ElringKlinger celebrates it 30th anniversary in China. In 1993 the founding of the joint venture, Changchun Elring Gaskets Co. Ltd. took place. ElringKlinger today operates four plants in China – Changchun, Suzhou, Qingdao and Chongqing – employing 1,400 employees and which account for sales of EUR 184 million in 2022.

“There is no doubt that China, the world's largest vehicle market, remains a key market for us. We are continuing to systematically pursue the strategy of strengthening our core businesses and growing in the area of alternative drive technologies, thereby precisely addressing trends and changes in mobility”, says Dr. Stefan Wolf, Global CEO of the ElringKlinger Group

ElringKlinger and EKPO @ AUTO SHANGHAI 2023 | Hall 1.2, Booth 1BH008

Press conference on April 19, 2023 | 2 PM

![[Translate to English:] ElringKlinger auf Instagram [Translate to English:] ElringKlinger auf Instagram](/fileadmin/data/images/06-newsroom/01-content/social-media/elringklinger-social-media-instagram-1320x743.jpg)

![[Translate to English:] ElringKlinger auf Facebook [Translate to English:] ElringKlinger auf Facebook](/fileadmin/data/images/06-newsroom/01-content/social-media/elringklinger-social-media-facebook-1320x743.jpg)

![[Translate to English:] ElringKlinger auf LinkedIn [Translate to English:] ElringKlinger auf LinkedIn](/fileadmin/data/images/06-newsroom/01-content/social-media/elringklinger-social-media-linkedin-1320x743.jpg)

![[Translate to English:] ElringKlinger auf Xing [Translate to English:] ElringKlinger auf Xing](/fileadmin/data/images/06-newsroom/01-content/social-media/elringklinger-social-media-xing-1320x743.jpg)